To affect the federal funds rate in a floor system the fed cannot rely on open market operations.

Floor on fed funds rate.

The interest rate on fed funds transactions is typically sensitive to the level of reserve balances in the banking system and so changes made through these tools influences the fed funds rate.

For this reason the 75 bp reverse repo rate not the 100 bp rate for interest on reserves functions as the effective floor for the fed funds rate in the current u s.

Instead it must adjust the interest rate it pays on reserves.

The federal reserve lowered the fed funds rate to a range of 0 00 0 25 on march 15 2020 in response to the covid 19 pandemic and fed chairman jerome powell said that we do not see negative.

The large demand for fed funds would then force the fed funds rate down.

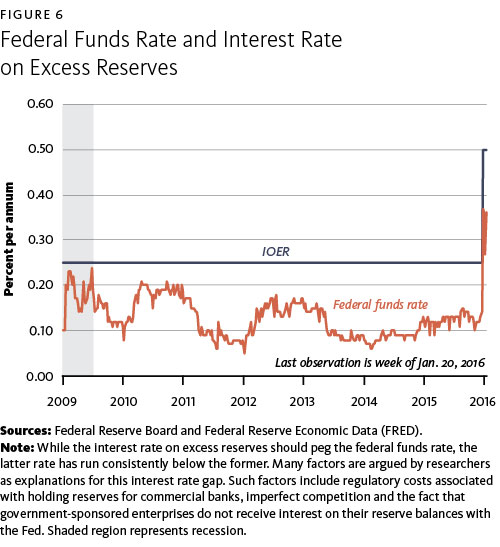

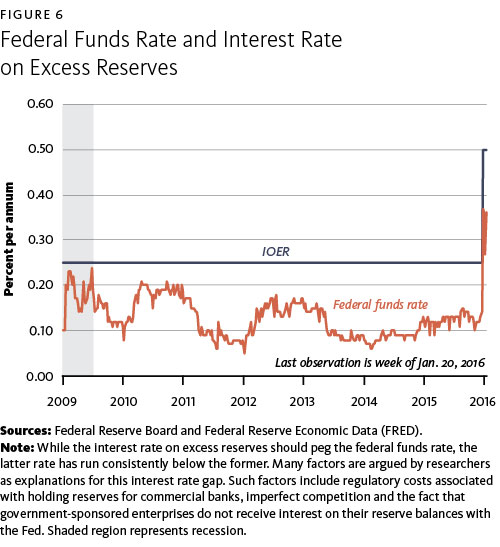

Williamson noted that in the few weeks that followed the average daily fed funds rate was typically within a range of 0 35 0 37 percent with one exception.

Most changes in the discount rate have no effect on the federal funds rate effect on discount rate change when supply curve.

The federal reserve has several tools that it can use to influence conditions in the federal funds market and thereby steer the market interest rate toward the chosen target.

The interest rate paid on reserves sets a floor for the federal funds rate o ff rate doesn t change o discount lending affects the federal funds rate by injecting reserves into the banking system effect of a discount rate change when supply curve is in vertical section.

If the fed funds rate were higher than the ioer then a bank wanting to lend would earn more interest on the fed funds market than by lending to the fed at the ioer.

A the new york fed publishes the effr for the prior business day on the new york fed s website at approximately 9 00 a m.

Thus in terms of results the fed has been successful in controlling the fed funds rate within the 0 25 0 50 percent range year end exception.

According to this logic controlling the fed funds rate should be easy for the fed under a floor system.

The effective federal funds rate effr is calculated as a volume weighted median of overnight federal funds transactions reported in the fr 2420 report of selected money market rates.

The fed s operating system changed from a corridor system to a floor system in 2008 i e from a system where money in the form of reserves mattered for monetary policy to one in which money.