A calculated pivot often called a floor trader pivot is derived from a formula using the previous day s high low and closing price the result is a focal price level about.

Floor pivots trading.

They re calculated based on the high low and closing prices of previous trading sessions and they re used to predict support.

Pivot point trading is also ideal for those who are involved in the forex trading industry.

Floor traders and other professionals who do the actual buying and selling of futures contracts in the trading pits of the exchanges generally employ very similar systems for valuing the price of these instruments in the absence of significant outside influences.

Types of pivots.

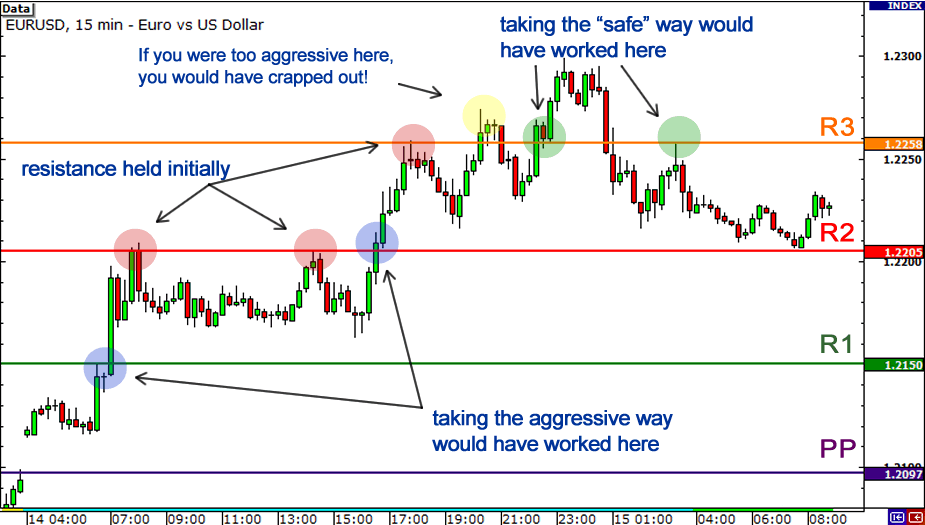

Pivot system support and resistance explained.

The name floor trader pivots comes from a time before online trading where floor trader s needed an easy formula to determine whether a price was relatively cheap or expensive before.

Smart forex traders can use this information to place their entry orders just below this or just below the s2 level to try and capture any further.

There are tons of pivot calculators that can quickly provide the levels with just a couple of clicks.

For example let s say you see that the s1 level is broken.

How to use floor trader pivots to improve your trading.

Due to their high trading volume forex price movements are often much more predictable than those in the stock market or other industries.

Floor trader pivots are one of the more popular pivot levels for active traders and are commonly used by floor traders in the trading pits.

The most popular method for calculating floor trader pivots is the original formula.

At the start of each trading day floor traders would look at the previous day s high low and close to calculate a pivot point for the current trading day stockcharts n d.

Pivot points are also called the floor pivot points.

Because the floor traders use these levels they ve become popular among people who trade off the floor attempting to follow the same techniques used by the professionals trading on the floors of the exchanges.

That main pivot point pp is the day s most important price level since it acts as the balance between bullish and bearish forces harrison 2011.

Calculate floor trader pivots.