The slab rates are 5 essentials standard rate of 12 and 18 and 28 for demerit goods.

Floor rate meaning in gst.

Igst exemption concession list as on 03 06 2017.

Parliament s standing committee on finance has suggested a floor rate and ceiling in the proposed goods and services tax gst and making it optional for states to introduce indirect tax reforms.

Classification scheme for services under gst.

The gst is usually taxed as a single rate across a nation.

50 lacs or any such amount as decided by gst council can opt for composition scheme wherein they need to discharge tax at 1 or 0 5 or any rate.

Reduced gst on sale or purchase of coir mats.

Decisions taken by the gst council in the 16th meeting.

Gst rate for wool animal hair yarn of horsehair woven fabric.

Cess is likely on five products including luxury cars tobacco aerated drinks.

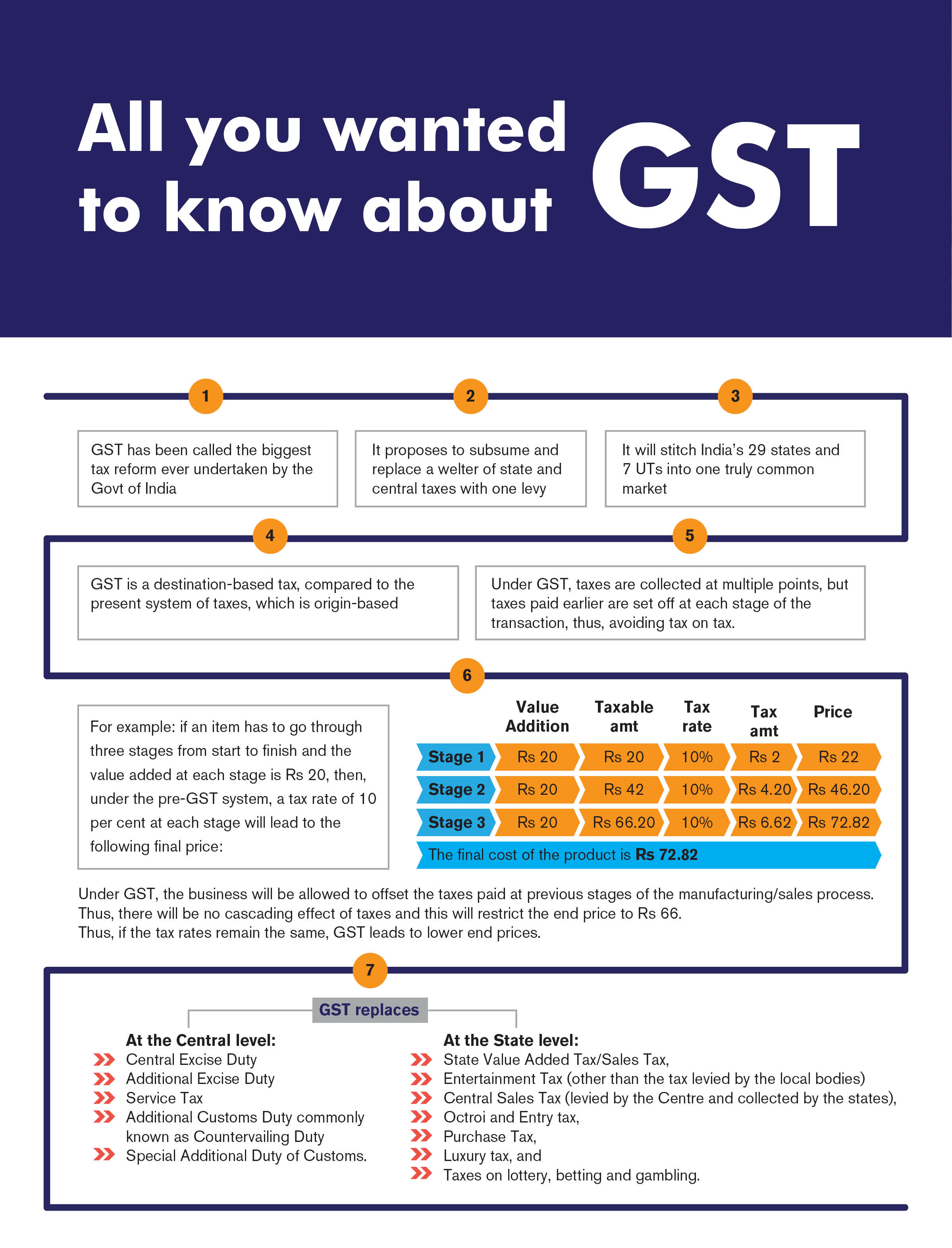

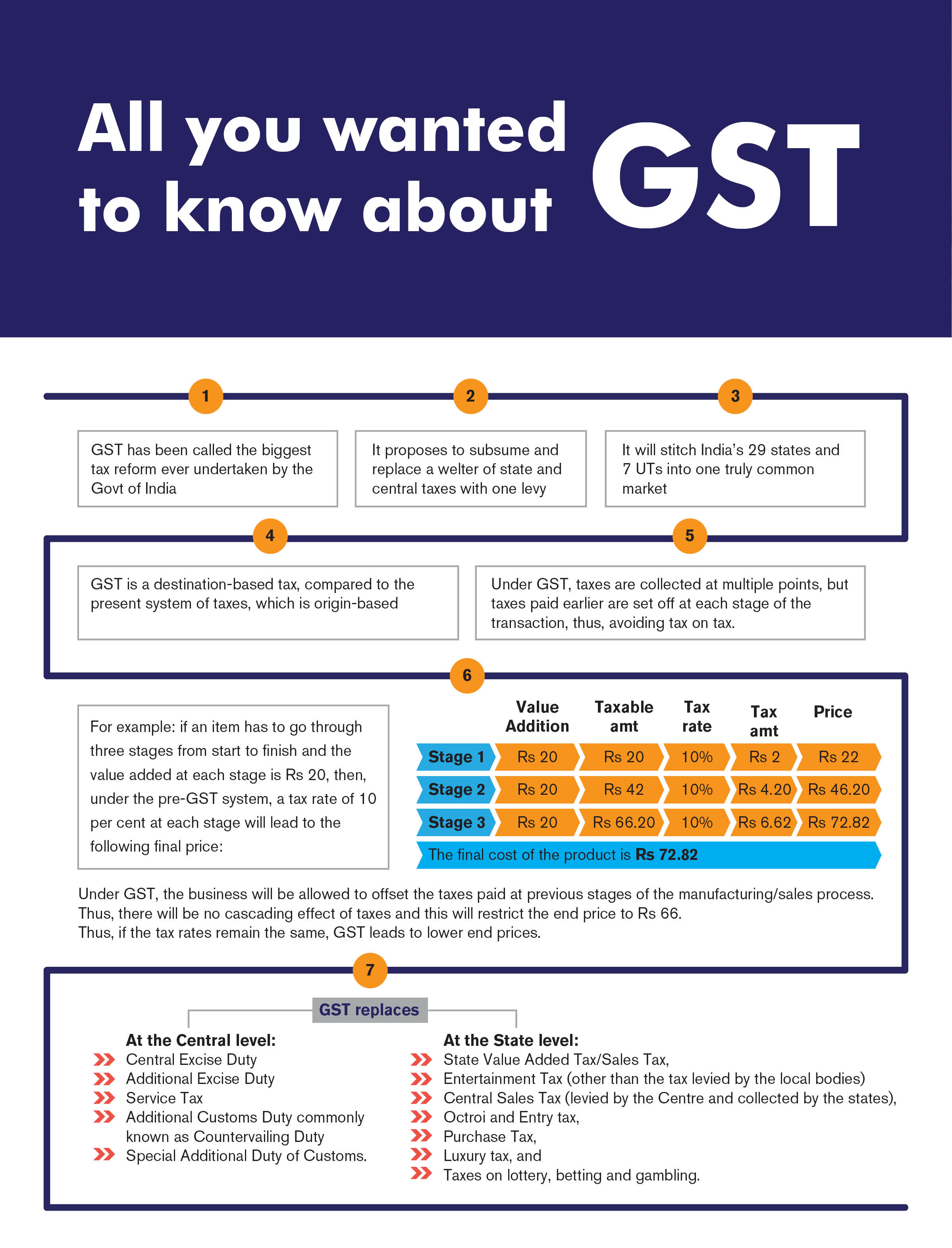

Gst is perhaps the biggest tax related reform in india since independence bringing uniformity in the taxation structure and eliminating the cascading of taxes that was levied in the past the gst council meets from time to time to revise the gst rates for various products.

Gst amount of rate on sale or purchase of coir mats matting and floor covering.

Cut down gst scheduled rate on coir matting and floor covering.

Gst rates of goods.

Revised threshold for composition scheme as on 11 06 2017.

Gst for carpet industries and sale of textile floor coverings.

Several states and industries recommend reduction in gst tax rate for various items which are discussed in these meetings.

Understanding the goods and services tax gst the goods and services tax gst is an indirect federal sales tax that is applied to the.

Gst acts cgst act 2017 as amended up to 30 09 2020.

Gst rate slabs were finalized during gst council meeting on november 3 2016.

Gst rates of services.

This will lead to multiple tax rates in gst while the government s original intent was to have a uniform rate across the country.

Cess would be levied on certain demerit goods over and above the rate of 28.

Interest rate floors are utilized in derivative.

Earlier the centre wanted a uniform rate for gst but later it agreed to have a floor rate with a narrow band on insistence of the states however differences still remain on many issues such as the revenue neutral rate threshold and dual control among others but these can be addressed by gst council.