In a fixed indexed annuity the floor is expressed as a guaranteed minimum interest rate this floor is usually set at at an annual rate of 0 meaning that even if the index decreases in value the interest to be credited won t be negative.

Floor rate on a annuity.

For example when a buffer annuity offers a 10 buffer against losses the insurance company offering the product will absorb the first 10 of losses associated with the product.

Equity indexed annuities may appeal to moderately.

For the 1 year illustration chart the s p 500 index returned 4 38 including dividends while the annuity s credited rate is calculated to be 0.

Life insurers can structure the minimum credit rate guarantees included in the annuity contracts to be different at least in some years than the minimum nonforfeiture interest rate floor.

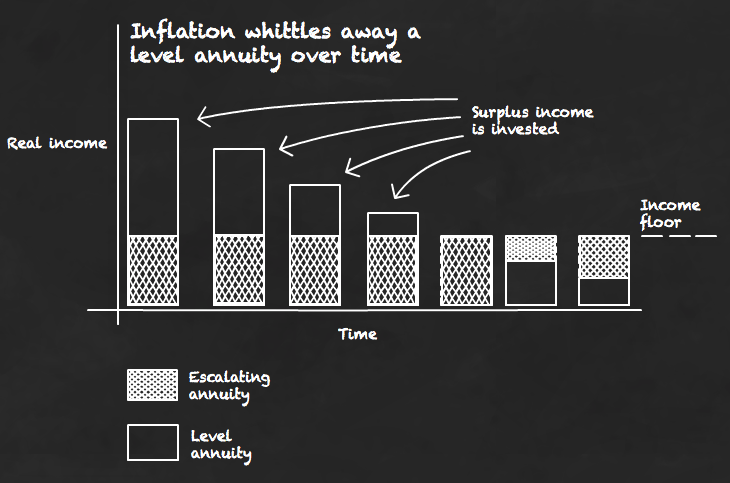

Annuities should provide a floor of guaranteed.

Indexed annuities give buyers an opportunity to benefit when the financial markets perform well.

Interest rate floors are utilized in derivative.

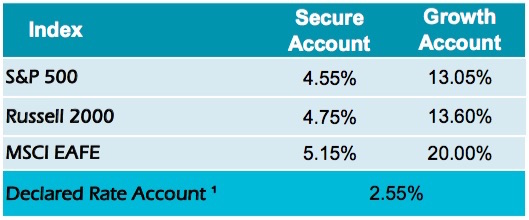

Generally fixed indexed annuities fias have an interest rate floor which is the minimum interest that will be credited each period typically 0 a participation rate which is the percent of an index that will be used to calculate interest crediting and or a cap which is the maximum interest that will be credited.

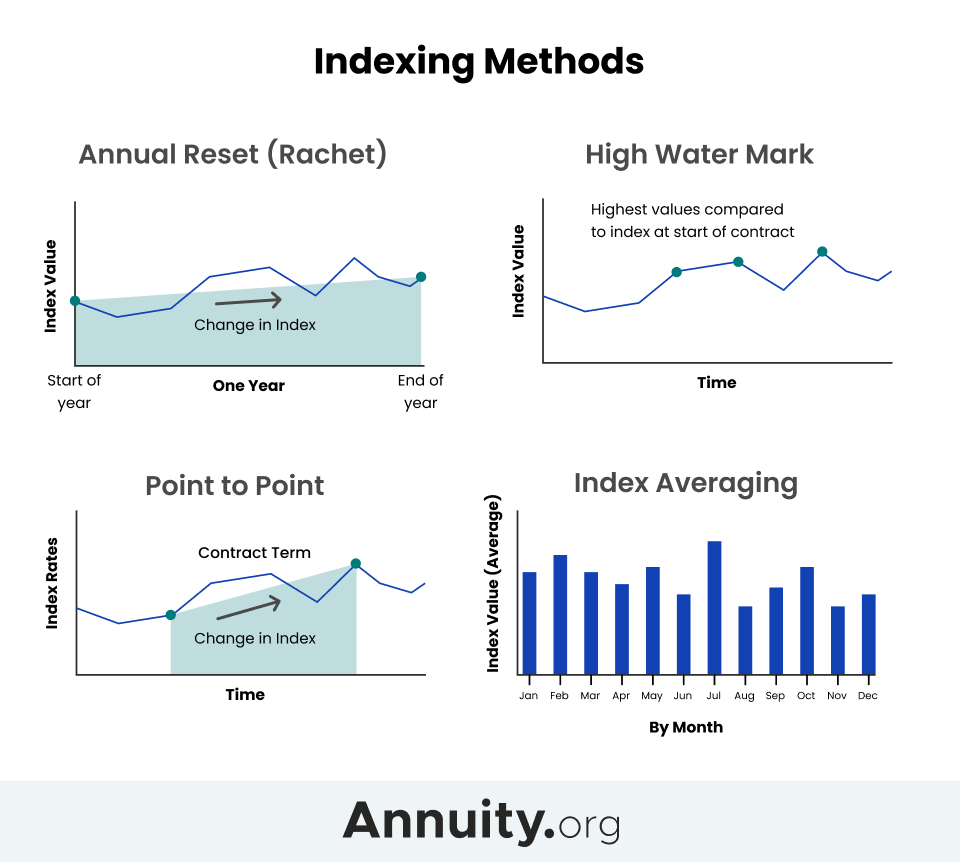

The indexed annuity annual crediting rate is based on the sum of the monthly changes in the s p 500 index.

An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product.

An indexed annuity pays a rate of interest based on a particular market index such as the s p 500.

How an fia works.

Each month s return is capped at 1 5.

Some index based financial products have a floor or the maximum value you would lose if the index went down.